Enabling charity beneficiaries to claim franking credits from deceased estates

When shares are an asset of deceased estates, sometimes there are franking credits available to be claimed. Depending on how the shares were treated during the administration of the estate, those credits may need to be claimed directly by the beneficiaries, including any charitable beneficiaries.

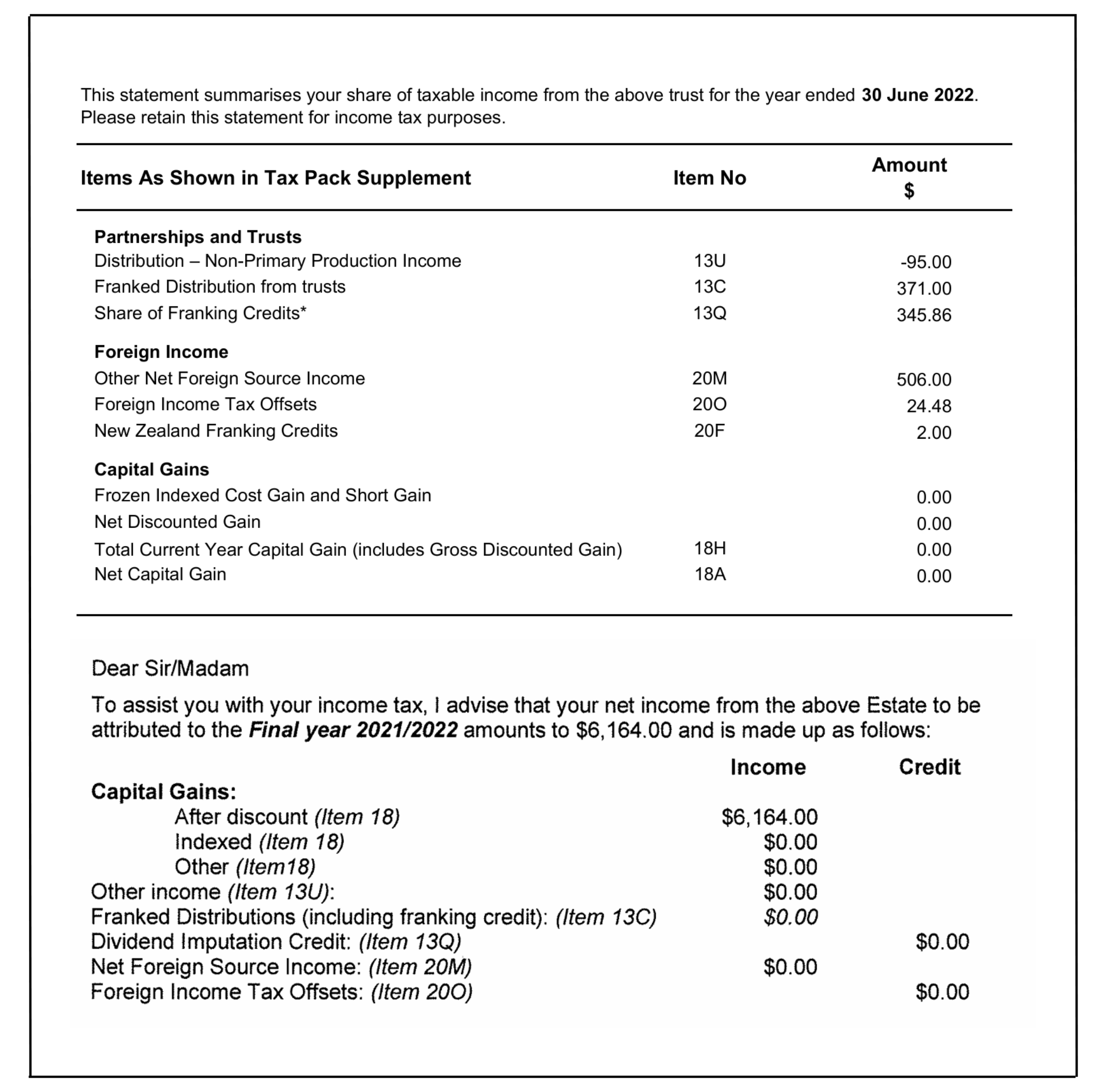

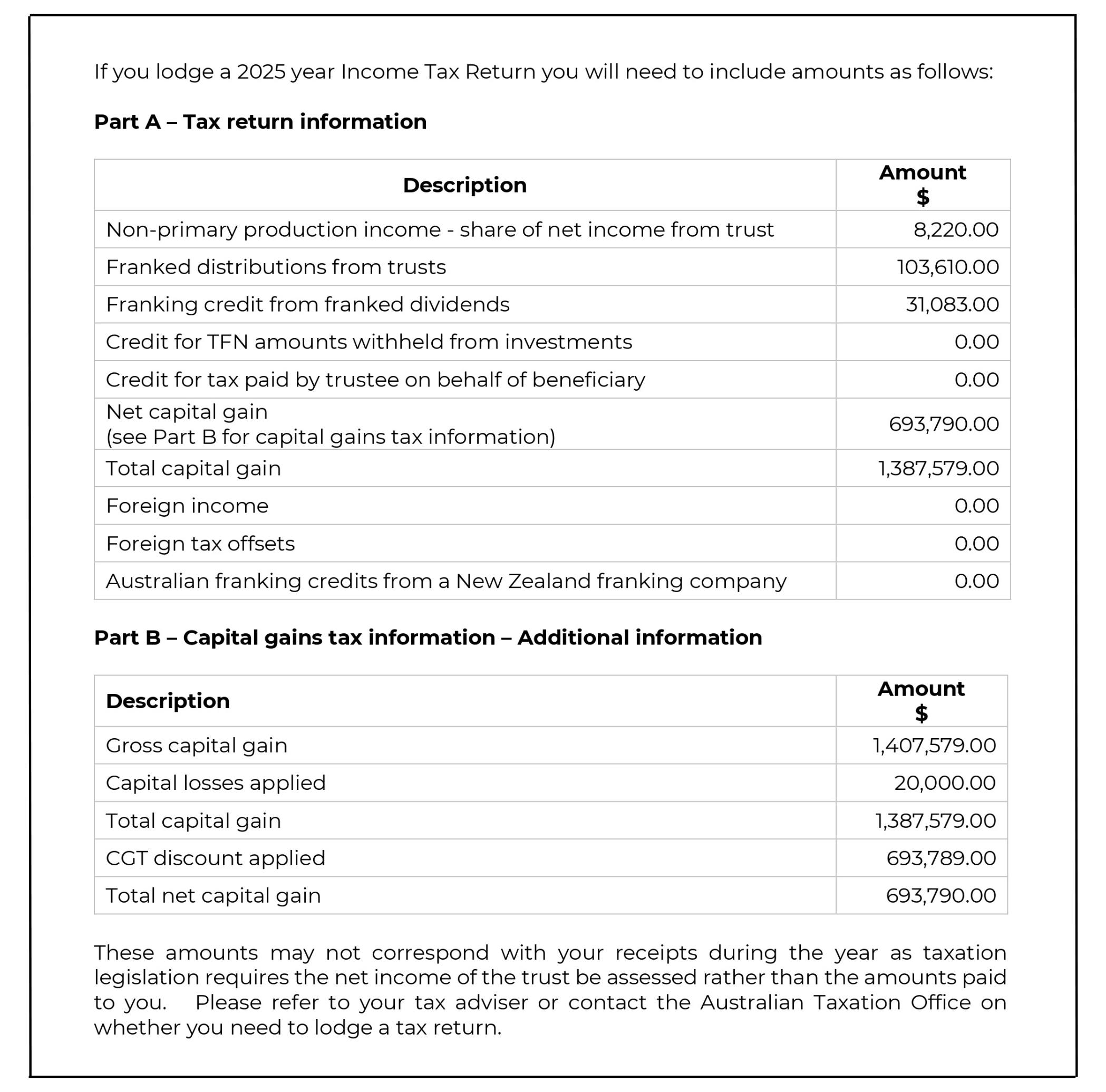

Where charity beneficiaries of deceased estates are entitled to claim franking credits from an estate, we ask that you provide us with appropriate documentation to allow them to do so. This can be a copy of the estate’s tax return from the relevant year/s, or a simple statement of taxable income such as the examples below.

If you could send this documentation to us at info@bequestassist.com.au whenever it is available, we will be most grateful. We will provide this to the charity’s finance team to ensure that they claim any franking credits for use in their important work.

Example One:

Example Two: